Anti-Money Laundering

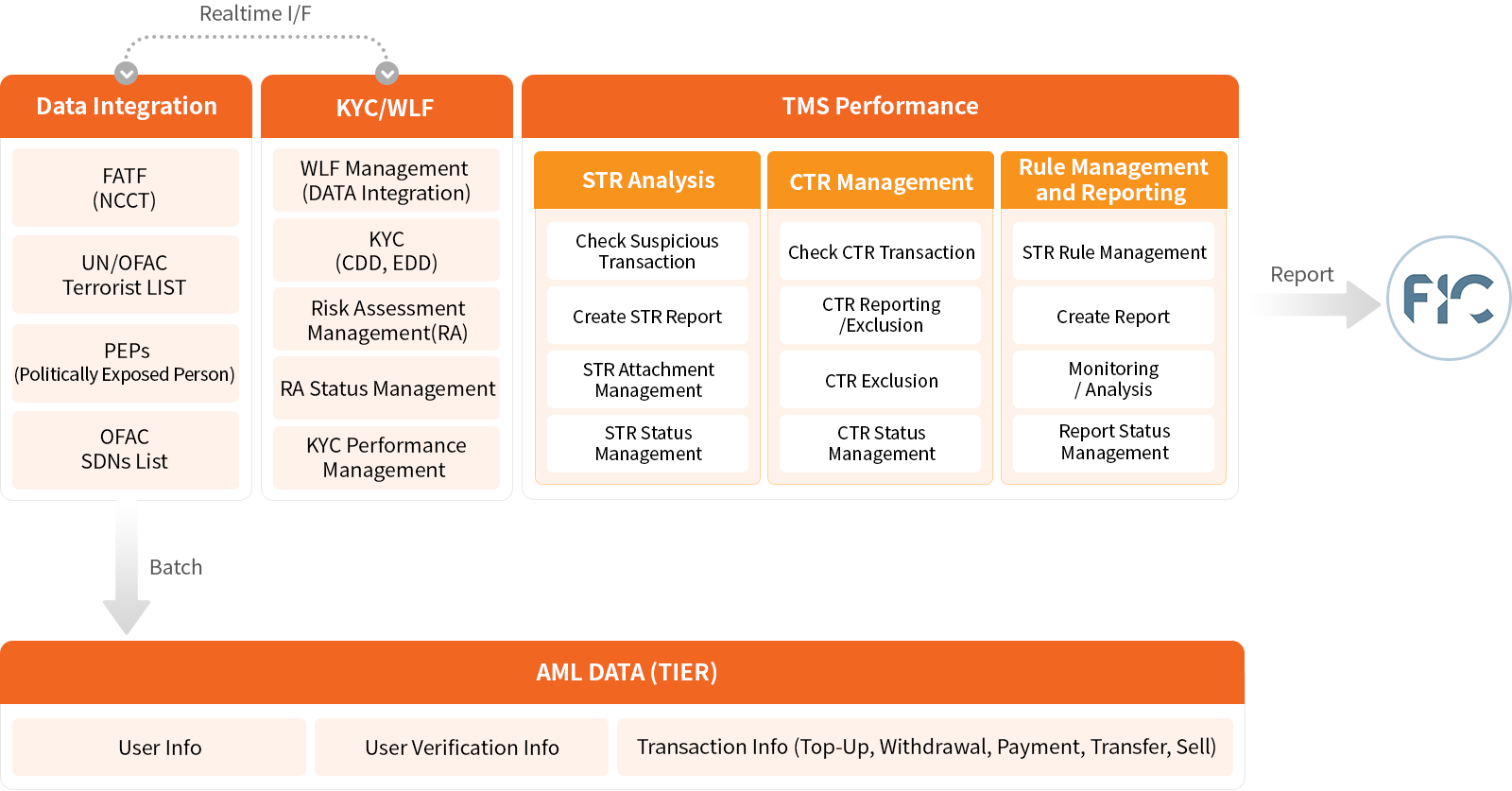

Ennova Holdings is regulated by the international anti-money laundering organization FATF.

The main tasks for compliance are customer due diligence (CDD) and enhanced due diligence (EDD), which are requirements of the Know Your Customer (KYC) system.

In addition, we strive to detect and prevent the laundering of illicit funds by conducting watch-list filtering (WLF), customer risk assessment (RA), suspicious transaction reporting (STR), and large cash transaction reporting (CTR) through the transaction monitoring system (TMS).

01

Features

KYC

- Customer Identity Verification through Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)

- Customer Risk Assessment (RA)

- Watch-List Filtering (WLF)

CTR Report

- Reporting large cash transactions

- Reporting based on transaction amount

- Information about the transaction, including the identity of the transactor, etc.

STR Report

- Reporting suspicious transactions

- Reporting based on suspicious activity

- Includes information about the transaction, the basis for suspicion, and the results of the analysis

Rule Management

- Suspicious Transaction Rule model registration, Risk Classification registration

- Change rule requirements and manage class rating

- Monitoring model evaluation, define criteria for data research analysis

Transaction Monitoring

- Management of suspicious transaction monitoring and reporting status

Institutional Data Integration

- Watchlist, Terrorist

02

Architecture

Credit Rating Model

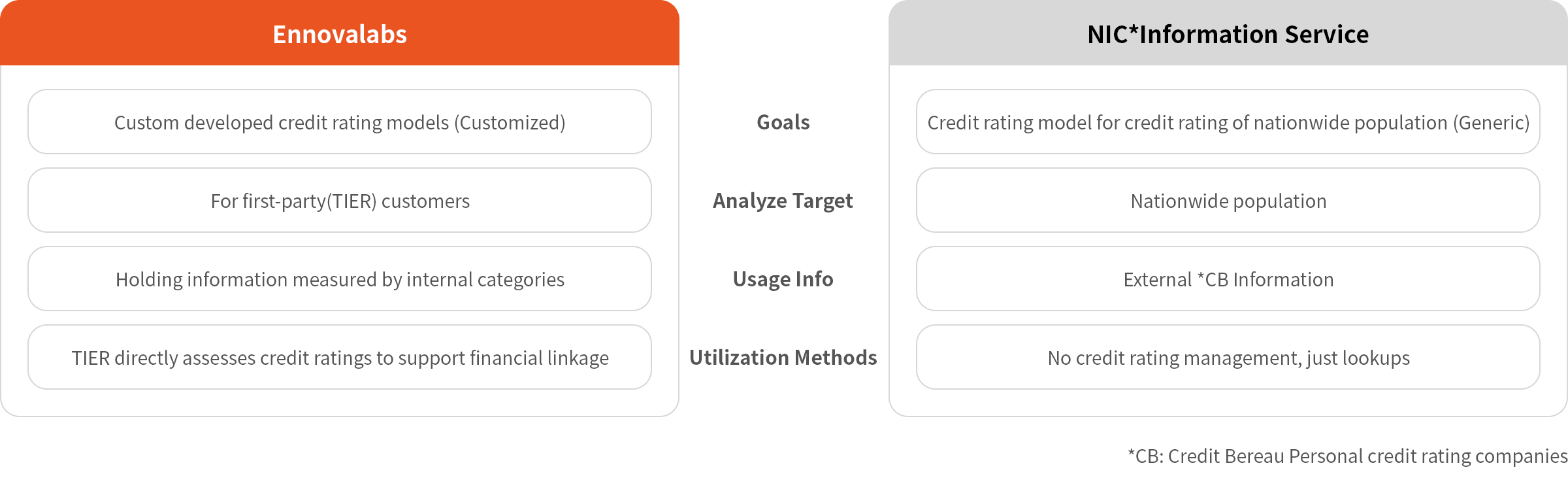

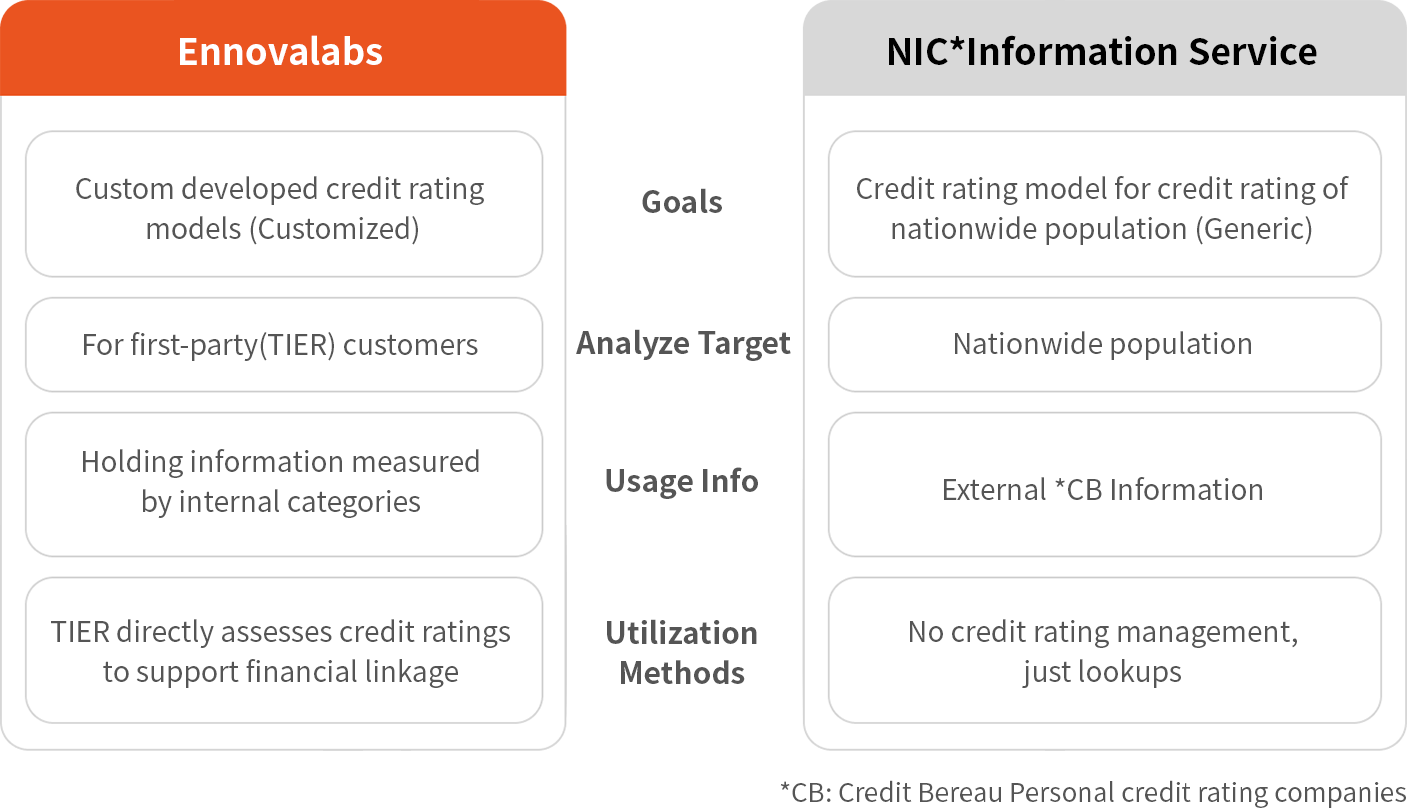

Our credit rating model using big data technology is an important tool for providing more accurate and personalized financial services.

To this end, Ennova Holdings will pave the way for various individuals, including the financially underprivileged, to access more appropriate financial services and secure economic stability.

01

Metrics

Ennova Holdings develops and provides big data-based credit rating models by collecting data such as transaction history, average balance, and telecommunication bill payment performance for top-ups and transfers using our Tier (user, merchant) service.

Top-Up

Transaction History

Average Balance

Utility Bill Payment History

02

Differentiation Strategy

Unlike traditional credit rating models that utilize past financial transaction history to measure creditworthiness, the ability to leverage your own data to measure creditworthiness allows for a more accurate and broader assessment of a customer's creditworthiness. This enables customers to be better matched to financial services, such as financial loan services, and allows them to access financial services even if they have no or insufficient existing financial transaction history.

03

Implementation Effects

Personalization

Utilize first-party data for credit rating, rather than the typical credit rating system that applies the same criteria to everyone.

Provide a personalized credit rating for each individual for more accurate credit ratings

Differentiation

Utilizing our credit rating model in developing countries to provide differentiated financial services based on lack of financial transaction history.

Increase satisfaction by meeting user needs not met by existing local financial institutions

Simplification

Not only can anyone with a smartphone using TIER calculate, but can also be managed and financially linked.

Free, simple and fast credit management and viewing through TIER platform